Miami Hard Money lenders

AFI Advantage

At AFI Private Lenders, we specialize in helping real estate investors in Miami fix up and build on their next opportunity. Whether you're rehabbing a duplex in Little Havana, flipping a single-family home in North Miami Beach, or building new construction in Doral or Miami Gardens, our private lending programs are built to move at the speed of Miami real estate. We offer fix and flip loans and ground-up construction financing for experienced and first-time investors alike — with funding based on the property, not your tax returns.

As a direct Miami hard money lender, we serve investors in neighborhoods like Wynwood, Hialeah, Pinecrest, Cutler Bay, South Miami, and Coral Gables. Our local knowledge and flexible terms make us the go-to lender for investors looking to close quickly and scale their business in one of the hottest markets in the country.

What Type of Loan Programs Do You Offer in Miami, FL?

At AFI Private Lenders, we offer a range of flexible loan options designed to meet the diverse needs of real estate investors in Miami:

Fix and Flip Loans

Short-term financing to purchase, renovate, and resell residential properties.

Bridge Loans

Fast gap funding for transitional properties or auction purchases.

New Construction Loans

Ground-up financing for single-family, townhome, or multifamily projects.

Cash-Out Refinance

Leverage equity from your existing properties.

DSCR Loans

Long-term rental financing based on the property’s income, not your personal financials.

Commercial Property Loans

Private capital for office, retail, or mixed-use investments.

Investment Opportunities in Miami, FL

Miami is a dynamic city with a thriving real estate market fueled by tourism, international investment, and steady population growth. Its coastal location and luxury appeal make it an ideal destination for upscale residential and commercial development. With rising property values and consistent deal flow, Miami continues to attract both new and seasoned real estate investors.

The fast-paced nature of Miami’s market makes hard money loans a strategic financing tool.

These loans offer quick funding and flexible terms, allowing investors to act fast on competitive deals, distressed properties, and renovation projects. Compared to traditional bank financing, hard money provides the speed and adaptability necessary to keep up with Miami’s rapidly changing market conditions. This is especially valuable for fix-and-flip opportunities, ground-up builds, and unconventional properties that may not qualify for conventional financing.

High demand from both U.S. and international buyers—especially from Latin America and Europe—continues to push property values upward. Investors benefit from both short-term profits and long-term appreciation, particularly in the high-end and luxury sectors of the market.

Key Investment Neighborhoods

We don’t just lend in West Palm Beach — we provide private lending solutions across all of Palm Beach County, Florida, including cities like Atlantis, Belle Glade, Boca Raton, Boynton Beach, Briny Breezes, Delray Beach, Greenacres, Gulf Stream, Hypoluxo, Juno Beach, Lake Worth Beach, Lantana, Loxahatchee, Manalapan, Mangonia Park, North Palm Beach, Ocean Ridge, Pahokee, Palm Beach, Palm Beach Gardens, Palm Springs, Riviera Beach, Royal Palm Beach, South Bay, South Palm Beach, Tequesta, Wellington, and Westlake.

We can customize your private money loan in Miami, FL

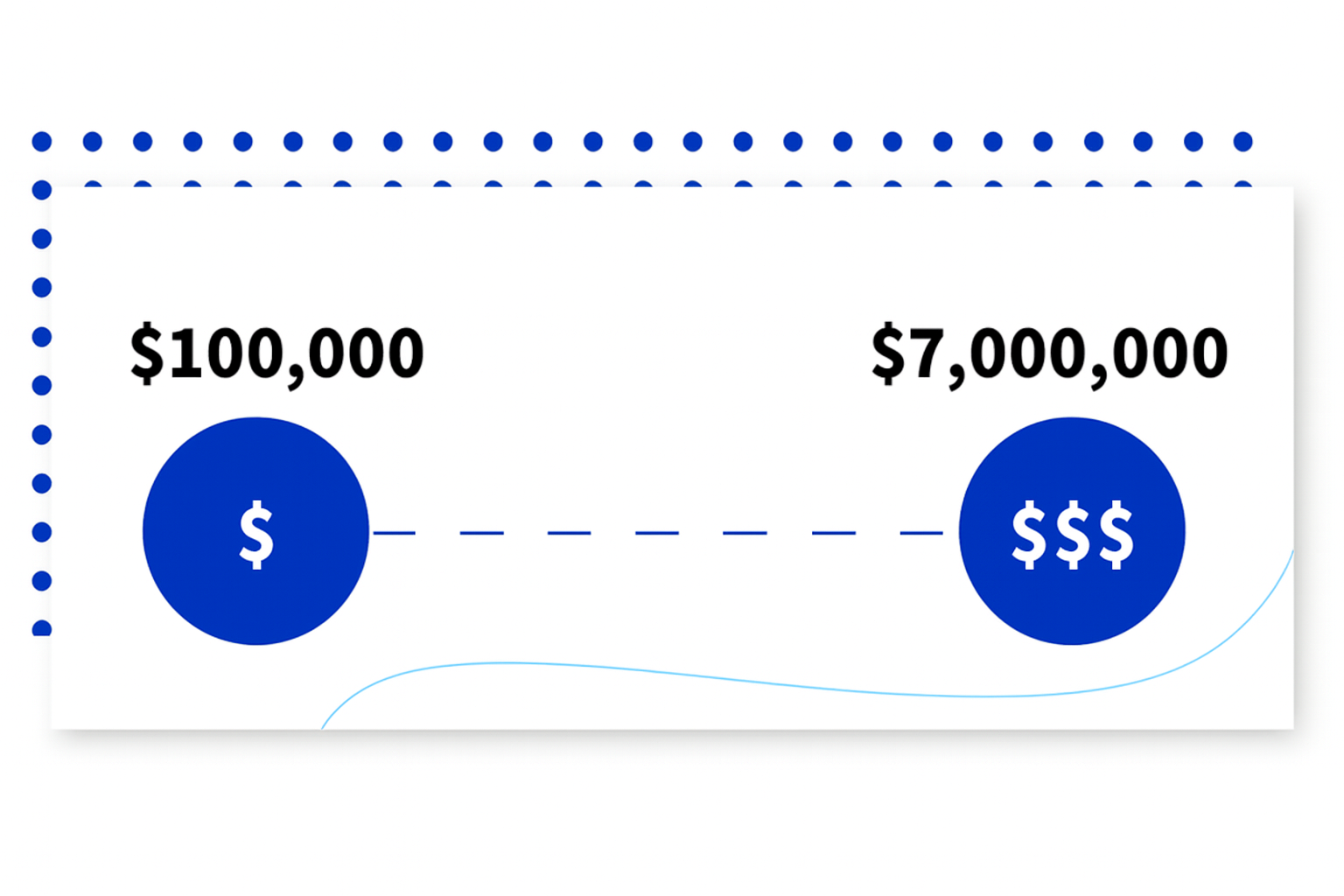

At AFI Private Lenders, we’re dedicated to supporting your real estate goals with flexible financing options. Our typical loan offerings span from $100,000 to $7,000,000, accommodating a wide spectrum of project sizes. Should your funding needs fall outside this range, our team is ready to work with you to craft a personalized solution that aligns with your unique objectives.

Current Property Trends

Vacation Rentals: The rise of short-term rental platforms like Airbnb has made tourist-friendly neighborhoods, such as South Beach, prime areas for high cash-flow investments.

Mixed-Use Properties: With population growth and urban density on the rise, developments that blend residential, retail, and office space—especially in Brickell and Downtown—are increasingly popular.

Miami offers a wide range of real estate investment opportunities with the potential for strong returns, whether you're flipping homes, developing high-end properties, or capitalizing on the city's booming rental market.