Broward County Hard Money lenders

The AFI Advantage

At Action Funding, Inc., we provide fast, flexible hard money loans for real estate investors across Broward County, including Fort Lauderdale, Hollywood, Pompano Beach, and beyond. Whether you're flipping a single-family home in Lauderhill, building new construction in Miramar, or refinancing a rental in Wilton Manors, our private lending solutions are built for speed, simplicity, and success.

With loan approvals based on the property—not your income or tax returns—we empower both seasoned and first-time investors to close quickly and compete in one of South Florida’s most active real estate markets.

As a Florida-based direct private lender, we understand the fast-paced dynamics of the Broward market. We’ve helped investors close deals throughout Fort Lauderdale, Sunrise, Pembroke Pines, Tamarac, Coral Springs, and Dania Beach—providing local expertise, streamlined underwriting, and reliable funding when timing matters most.

What Type of Loan Programs Do You Offer in Broward County, FL?

At AFI Private Lenders, we offer a range of flexible loan options designed to meet the diverse needs of real estate investors in Miami:

Fix and Flip Loans

Short-term financing to purchase, renovate, and resell residential properties.

Bridge Loans

Fast gap funding for transitional properties or auction purchases.

New Construction Loans

Ground-up financing for single-family, townhome, or multifamily projects.

Cash-Out Refinance

Leverage equity from your existing properties.

DSCR Loans

Long-term rental financing based on the property’s income, not your personal financials.

Commercial Property Loans

Private capital for office, retail, or mixed-use investments.

Where Else Do We Lend in Broward?

We don’t just lend in Fort Lauderdale — we provide private lending solutions across all of Broward County, Florida, including cities like Coconut Creek, Cooper City, Coral Springs, Dania Beach, Davie, Deerfield Beach, Hallandale Beach, Hillsboro Beach, Hollywood, Lauderdale Lakes, Lauderhill, Lazy Lake, Lighthouse Point, Margate, Miramar, North Lauderdale, Oakland Park, Parkland, Pembroke Pines, Plantation, Pompano Beach, Sea Ranch Lakes, Southwest Ranches, Sunrise, Tamarac, West Park, Weston, Wilton Manors, and of course, Fort Lauderdale.

Smart Investors Look at Broward, Here's Why

We Can Tailor Your Bridge Loan in Broward County, FL

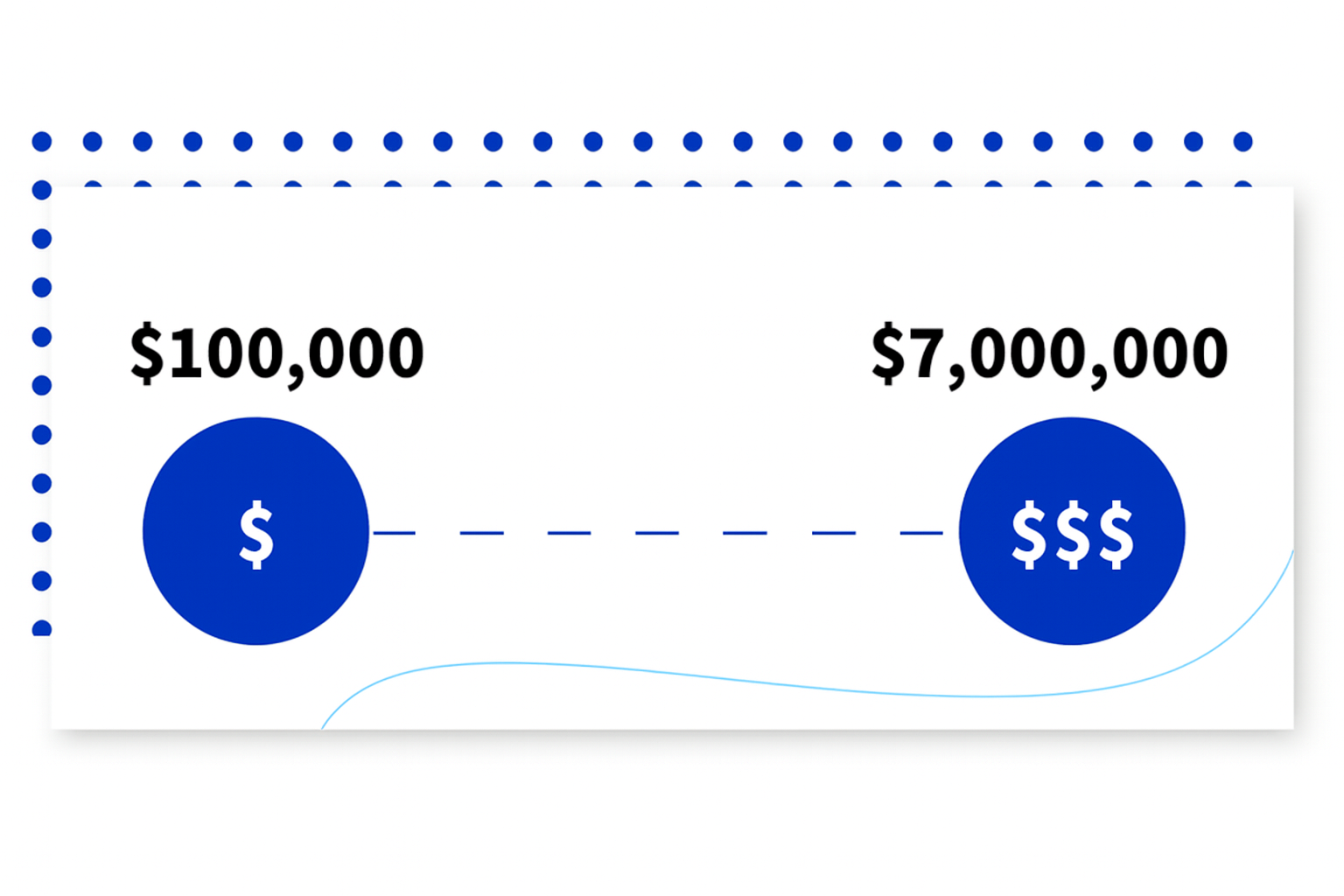

At AFI Private Lenders, we’re dedicated to supporting your real estate goals with flexible financing options. Our typical loan offerings span from $100,000 to $7,000,000, accommodating a wide spectrum of project sizes. Should your funding needs fall outside this range, our team is ready to work with you to craft a personalized solution that aligns with your unique objectives.