Partner Program

For realtors, mortgage brokers and other real estate professionals

Partner With Us: Broker-Friendly Hard Money Lending. At Action Funding, we welcome partnerships with real estate brokers on both referred and brokered transactions. Our process is streamlined, transparent, and designed to make your job easier—with no application or membership fees.

We value strong, reliable broker relationships. Our current broker partners often praise how quickly deals get done and how fast they’re paid. We ensure every broker is protected and compensated at closing—every time

How It Works

Elevate Your Brokerage and Enhance Your Borrower's Experience

1. Apply to the referral program online

Compete the application form. Once approved, you can submit deals, online via email, or call our office.

2. Send clients to apply for a loan program

Send clients to our online loan application. From there, we will schedule a zoom meeting to discuss their funding needs and send a same day term sheet.

3. When a loan closes, you get paid up to 2% of loan amount

When a loan is issued to your client, you will be rewarded with your payout of points.

About Action Funding

Action Funding’s mission is to strengthen local communities by providing real estate investors with fast, flexible, and accessible capital. We’ve developed a platform that delivers instant online loan approvals, term sheets, and proof of funds—allowing investors to make offers within minutes.

Our technology uses real-time data to power smarter lending decisions and equip investors with analytical tools that enhance their investment strategies. Through the Action Funding platform, investors can identify profitable real estate opportunities, analyze potential returns, and secure financing for their projects—all in one seamless digital experience.

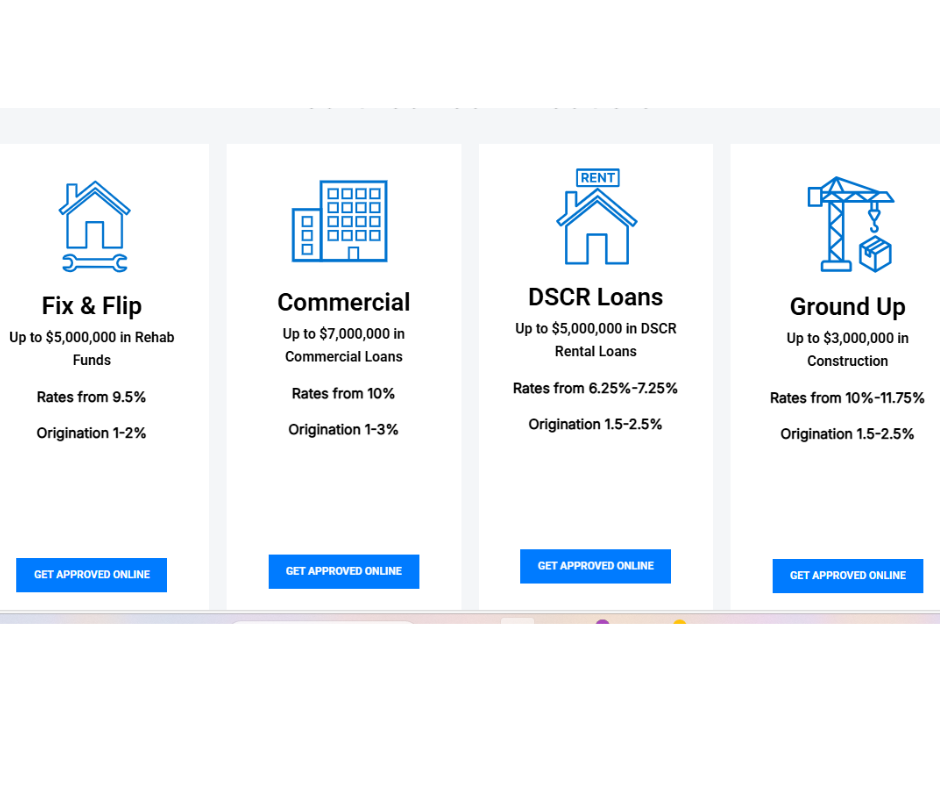

Eligible Loan Products

Rates from 10%-11.75%

Origination 1.5-2.5%

Frequently Asked Questions

Action Funding will fund fix & flip, commercial loans, cash out refinances, ground up construction loans, and much more. We do not do consumer loans.

Action Funding goes up to 70% of the future value (ARV) of the property. We use this approach in instead of the typical LTC.

Action Funding typically charges anywhere between 1-3 points depending on the deal. Our brokers typically receive 2 points.

Yes, Action Funding can go behind banks, not other private lenders.

We value the deal more than the person. Many of our borrowers were first time flippers or builders when they started with us.