The investing playbook is shifting. Tactics that once felt like golden rules — chasing off-market deals, obsessing over interest rates, and relying on all-cash offers — aren’t delivering the same results they used to. While they still matter, today’s market is rewarding investors who adapt and diversify.

1. Off-Market Deals Aren’t the Only Winners

Investor Insight

For years, “go off-market” was the rallying cry of savvy investors. Off-market properties still offer opportunities, but in 2025, MLS strategies are proving just as profitable.

- Discounted listings: Recent Redfin data shows that homes listed for 60+ days often sell at bigger markdowns than new inventory. Stale listings with motivated sellers can be just as lucrative as private deals.

- Competition overload: The off-market arena has become crowded with wholesalers, investors, and endless cold calls. Standing out now costs more, eating into margins.

- MLS advantages: Targeting “90+ day” listings and negotiating aggressively can outperform off-market hunting.

- Institutional presence: Hedge funds and iBuyers use algorithms to scoop up distressed homes before most individual investors can.

Takeaway: Don’t abandon off-market deals, but treat MLS leads with equal weight. A blended sourcing approach creates more consistent deal flow.

2. Interest Rates Aren’t the Whole Story

Investor Insight

Headlines love interest rates — and yes, they matter. But in 2025, other costs are rising even faster, sometimes cutting deeper into profits than financing.

- Insurance spikes: In markets like Florida, insurance premiums have doubled in recent years, reducing margins by several percentage points.

- Taxes & fees: Property taxes and transfer fees are climbing in many metros, taking a bigger bite out of cash flow.

- Regulatory delays: Permit backlogs and slow approvals can drag projects out, with holding costs eroding returns faster than small rate hikes.

Takeaway: Smart investors build underwriting models that weigh insurance, taxes, utilities, and delays alongside debt service. ROI depends on the full cost picture, not just the mortgage rate.

3. Cash Isn’t Always King

Investor Insight

Cash offers once guaranteed a leg up. In 2025, though, speed, certainty, and flexibility often matter more. Redfin reports that cash purchases dropped to 32.6% of U.S. home sales in 2024 — the lowest share in three years.

- Seller priorities: Quick closings, waived contingencies, and flexible rent-backs can outweigh cash.

- Financing confidence: Strong pre-approvals and fast-close commitments are competing directly with all-cash buyers.

- Institutional pressure: Large buyers with financing in place often outbid cash offers while still giving sellers what they want.

Takeaway: Craft offers that solve sellers’ real needs. Whether through hybrid financing, flexible terms, or certainty of close, investors with creative strategies are winning deals over pure cash.

The Bottom Line: Adaptability Wins

The “big three” strategies — off-market focus, rate obsession, and cash dominance — haven’t disappeared, but they no longer guarantee success on their own. Investors who thrive in 2025 will:

- Leverage data-driven sourcing across both on- and off-market channels.

- Underwrite every expense, not just interest rates.

- Structure offers that prioritize seller needs.

Adaptability is the new competitive edge. Those willing to evolve with the market will be the ones leading the pack.

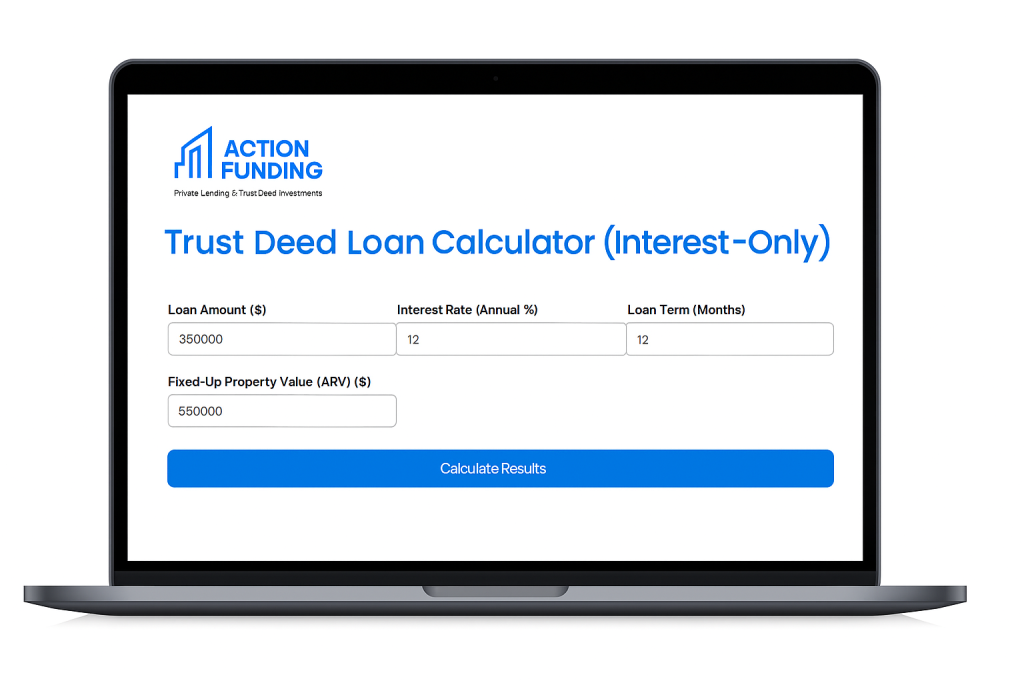

Get A Loan Quote Instantly